2025 Tax Brackets Single Filer. Your tax bracket shows you the tax rate that you will pay for each portion of your income. Here's what taxpayers need to know.

Single, married filing jointly, married filing separately, head of household, and qualifying widow(er) with dependent child. However, some of your income will be taxed in lower tax brackets:

2025 Tax Bracket Single Filer Jilli Lurleen, New 2025 income tax brackets and a higher standard deduction may mean tax cuts for many americans.

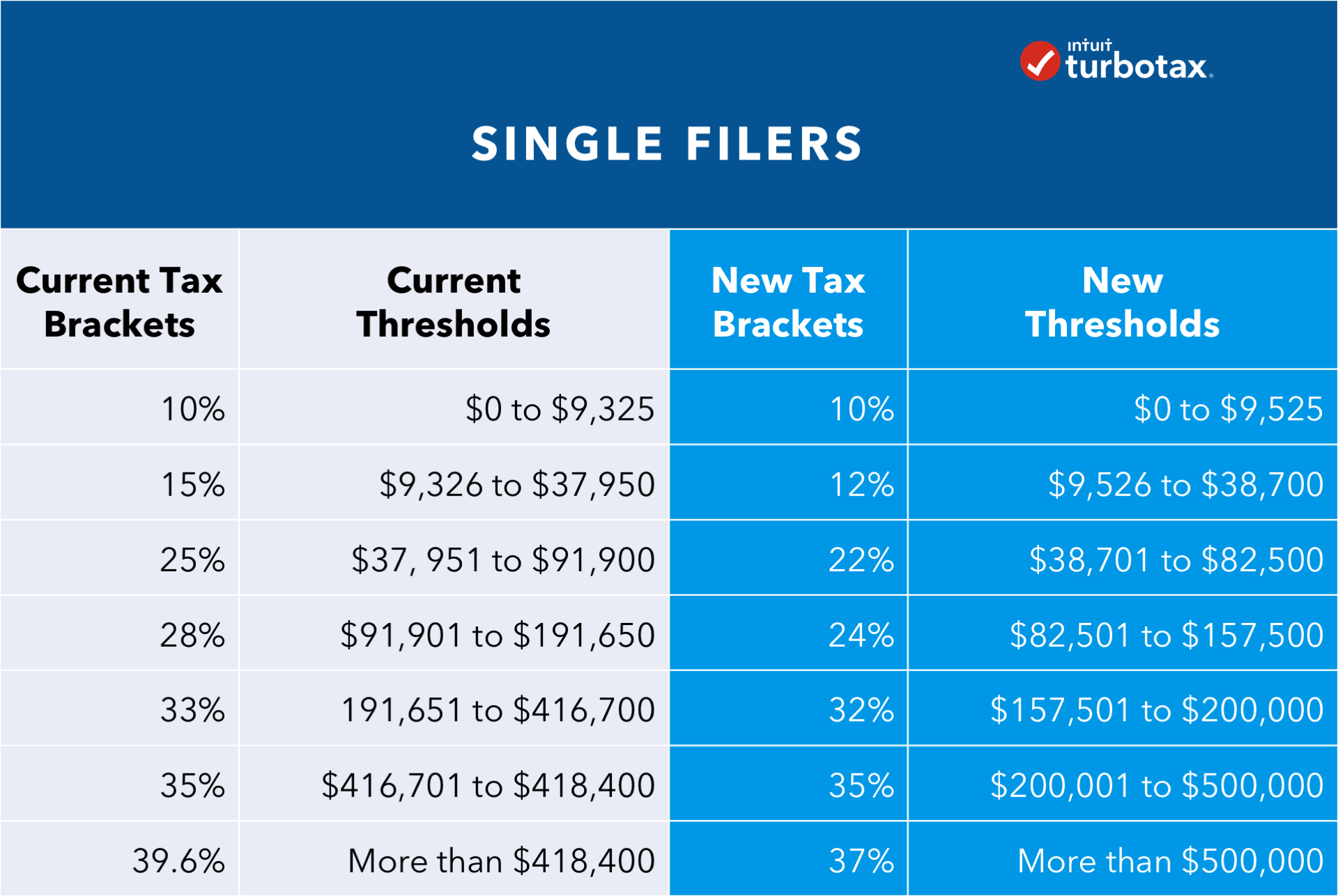

2025 Tax Brackets Single Filer Tool Libby Othilia, The seven federal income tax brackets for 2025 and 2025 are 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Single Filer Tax Brackets 2025 Tim Maridel, For example, if your taxable income as a single filer is $60,000 in 2025, you’ll pay 10% on the first $11,600 in taxable income.

2025 Tax Brackets Single Filer Nikki Analiese, The irs has announced higher federal income tax brackets and standard deductions for 2025.

IRS Tax Brackets 2025, Federal Tax Tables, Inflation Adjustment, This is up from a cutoff of $11,000 for 2025.

2025 Tax Brackets Single Filer Andi Madlin, As everyone expected, the irs adjusted the 2025 rates for this crazy inflation we’re facing.

Single Filer Tax Brackets 2025 Corrie Phyllys, Single, married filing jointly, married filing separately, or head of household.

2025 Tax Brackets Single Filer Andi Madlin, Then you’ll pay 12% on all income you make from.